An Unbiased View of Best Investment Books

Wiki Article

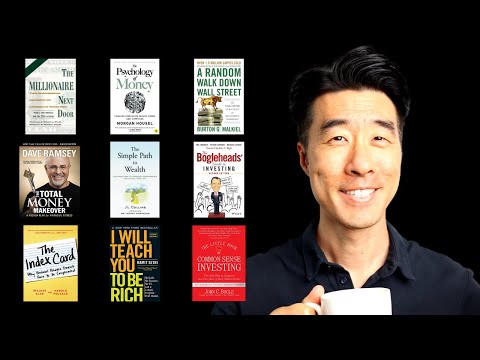

Ideal Investment decision Books

There exists an variety of expenditure guides, but some get noticed. These titles have encouraged and shaped several of the best traders all through background and may be essential reading for any person wanting to further improve their monetary literacy or funds administration know-how.

Benjamin Graham's book on value investing, which includes purchasing stocks for less than their intrinsic value, can be an indispensable guidebook. It teaches audience how to achieve genuine returns with out taking needless challenges available in the market.

one. The Smart Investor by Benjamin Graham

The Single Strategy To Use For Best Investment Books

In terms of investing, staying clever with how you devote your cash is paramount to both equally making sure money stability and furthering your job goals. Money management expertise are a must have for legal professionals, Medical practitioners, investment decision bankers, digital Entrepreneurs and digital marketers. Regardless of whether you happen to be just commencing or a qualified investor there is usually more you can understand the market and creating intelligent monetary conclusions by looking through investing publications - irrespective of your background.

In terms of investing, staying clever with how you devote your cash is paramount to both equally making sure money stability and furthering your job goals. Money management expertise are a must have for legal professionals, Medical practitioners, investment decision bankers, digital Entrepreneurs and digital marketers. Regardless of whether you happen to be just commencing or a qualified investor there is usually more you can understand the market and creating intelligent monetary conclusions by looking through investing publications - irrespective of your background.Benjamin Graham, the pioneer of benefit investing, wrote The Clever Investor in 1949 to be a common that needs to be on each investor's shelf. It information the significance of lengthy-term investing and the way to stay clear of overpaying for shares; its ideas relating to speculation vs audio investments continue being pertinent these days which e book need to be go through by new and veteran investors alike.

Benjamin Graham and David Dodd's Stability Examination is an additional essential addition to each investor's library, giving an available introduction to worth investing concepts and follow. An excellent read through for newbies or anyone attempting to delve deeper into its rules - its central plan being: only acquire inexpensive shares in lieu of entirely on price tag alone!

This ebook not just introduces the basics of investing, but What's more, it handles debt administration and real-estate investments. Students along with every day buyers alike have praised its clarity and knowledge - it is essential studying for just about any aspiring or Energetic investor.

Among the list of main problems linked to starting to commit is recognizing how to shield your belongings towards sector fluctuations and Restrict threat. This ebook can help new investors get up and working by supplying easy guidance for protecting belongings and mitigating risk - it even covers how finest to make the most of retirement resources like 401(k), IRA and Roth IRA accounts.

two. The Minimal Book of Widespread Sense Investing by Robert Kiyosaki

One of the major novice financial commitment textbooks, this guide presents viewers with the many tools required to build their particular portfolios. Instead of making use of complex money jargon, this manual uses plain language to elucidate ideas in simple techniques - which includes picking an asset allocation and picking cash; in addition to Advantages linked to passive investing.

This ebook emphasizes the significance of sturdy Trader willpower for success. In addition, diversification and compound fascination are pressured. Private anecdotes from your creator assist carry these principles alive and reveal why they make a difference a great deal of.

This 1949 traditional stays essential looking at for anyone hoping to take advantage of purchasing shares. It provides Guidance on recognizing and analyzing businesses along with methods for investing. Additionally, this e book teaches about purchasing discounted shares whilst keeping away from common pitfalls like turning out to be seduced by developments and pursuing fads.

Not known Factual Statements About Best Investment Books

The author employs the supermarket being an illustration to show how traders can get a considerable edge by only purchasing underpriced things. This type of investing, referred to as worth investing, aims to seek out providers with sustainable competitive positive aspects whose share price tag mirror this competitive edge. Though benefit investing might appear eye-catching at the outset, recall it involves tolerance and motivation.

The author employs the supermarket being an illustration to show how traders can get a considerable edge by only purchasing underpriced things. This type of investing, referred to as worth investing, aims to seek out providers with sustainable competitive positive aspects whose share price tag mirror this competitive edge. Though benefit investing might appear eye-catching at the outset, recall it involves tolerance and motivation.This ebook, the youngest on this listing, ought to be study by anybody planning to enter the inventory marketplace. It outlines Peter Lynch's methods for beating the industry - earning him amongst record's good investors. It teaches average buyers can leverage selected strengths in excess of massive funds managers which include tax breaks and knowledge a business's financial moat; also emphasizing acquiring shares of substantial-high quality businesses and using a disciplined approach when shopping for stocks; it emphasizes comprehending that marketplaces might be volatile; system accordingly!

three. The Buffett Rule by Warren Buffet

The ideal investing textbooks will teach you ways to produce seem fiscal conclusions and expand your cash efficiently. Examining these types of publications can make even non-fiscal professionals into profitable traders; such as an entrepreneur, law firm, medical doctor or electronic marketer it may verify particularly valuable in furnishing beneficial tips to clientele or superiors at do the job.

Warren Buffett is considered one among the best traders at any time, and this ebook presents insights into his successful investing strategies. It describes why it's best to invest in good quality corporations investing at affordable valuations; how in order to avoid building psychological conclusions; the advantages of diversification; and why persistence need to generally be exercised when investing.

This reserve is usually thought of the "bible" of stock market investing. It handles fundamentals such as benefit investing - an approach advocated by Warren Buffett along with other effective investors - in addition to being familiar with business metrics and reading a equilibrium sheet. This textual content is good for beginners looking for their start in investing.

Burton Malkiel was a professional at distilling advanced Concepts into obtainable guides that any individual could read through very easily, as well as a Random Stroll Down Wall Street by Malkiel really should be needed examining for any person wishing to acquire the basic principles of investing. Malkiel's e-book provides lessons in diversification of portfolios and why index cash are exceptional inventory picking tactics - this function of literature was even advised by lots of productive hedge fund administrators themselves!

What Does Best Investment Books Do?

Peter Lynch was among the greatest fund supervisors at any time, earning an average once-a-year return of 29% at Magellan Fund all through his time there. A lot of his accomplishment is usually credited to classes taught On this reserve which explores how specific buyers can gain positive aspects around large funds professionals by making use of their knowledge of businesses' industries to their particular advantage. It is extremely encouraged by Bruce Berkowitz, John Griffin and Dan Loeb for all buyers alike.

Peter Lynch was among the greatest fund supervisors at any time, earning an average once-a-year return of 29% at Magellan Fund all through his time there. A lot of his accomplishment is usually credited to classes taught On this reserve which explores how specific buyers can gain positive aspects around large funds professionals by making use of their knowledge of businesses' industries to their particular advantage. It is extremely encouraged by Bruce Berkowitz, John Griffin and Dan Loeb for all buyers alike.4. The Minimal Ebook of Common Sense Buying and selling by Mathew R. Kratter

Being an investing amateur, getting started is often intimidating. From attempting to place that unused discounts account money to work to brushing up on investing abilities - these publications gives you everything you need to know on investing properly when preserving from marketplace fluctuations.

This guide takes advantage of parables set in ancient Babylon to teach fundamental ideas for saving and investing cash. It is an easy study with more than 80,000 5-star assessments on Goodreads; its messages instruct audience To place aside ten% in their cash flow for financial commitment with steerage prior to creating selections regarding where it should go; On top website of that you can understand steering clear of bad investments together with what actions need to be taken if problems have presently been made.

Published by a behavioral finance specialist, this reserve is for any person looking to improve their investing effectiveness. It demonstrates how investor actions and emotions impact conclusions created, right before click here detailing ways in which these is often altered for superior investing efficiency. Showcasing an accessible conversational model writing format that makes the reserve easy to read through.

Benjamin Graham's classic e-book, The Clever Investor, really should be on every single investor's looking through record. Below he lays out his benefit investing philosophy whilst educating viewers to invest in quality providers when they are undervalued although keeping away from dangerous speculation investments. It proceeds to inspire today's investors website as its concept stays timeless.

John Bogle's Protection Assessment must also be on any Trader's looking at listing, since he Established Vanguard and launched index mutual money. This ebook encourages its reader to undertake a protracted-phrase standpoint and minimize charges as much as you possibly can while greenback Price averaging can also be released for a demonstrated strategy for steady investing.